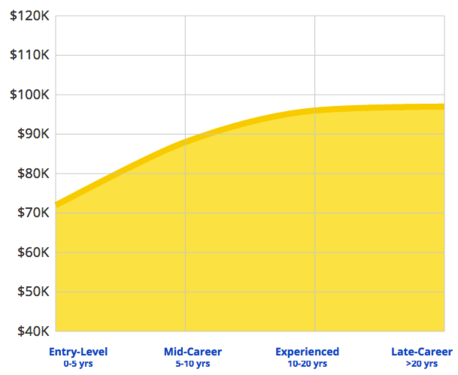

A career in Risk Management can be extremely prosperous for individuals that succeed in the business. However, in order to become successful, you must be well equipped, knowledgeable, and have the proper training and experience within the subject of risk management. Take a look at the graph below which breaks down the salary differences between multiple positions within the Risk Management field.

Median Risk Management Salaries in the U.S.

Why Study Risk Management?

With fluctuations in financial markets and the unpredictable nature of the business, risk really is everywhere. Companies around the world are beginning to invest heavily in careers and individuals who can minimize the potential of risk threatening their assets, profitability and business success. However, having the ability to detect trends and changes that could potentially hurt a business while shielding off these potential threats in the future is no easy task. Fortunately, learning the tools and techniques of risk management is simply at your fingertips!

The median annual Senior Financial Analyst salary is $78,256.

Risk Management Professional Certificate

Develop a comprehensive survey of the practice of Risk Management. The major types of risk are identified, risk management tools and techniques are reviewed and financial regulation is covered. Delegates will work through the annual risk report of a publicly traded financial institution. A number of case studies are analyzed to illustrate the key principles of risk measurement and management.

Seats go fast! Reserve your seat today for our next Risk Management Professional Certificate course.

“The course was stimulating and the professor was energetic, knowledgeable and passionate.

As an operations risk management professional and non-financial person, I felt this course was rewarding and a great investment.”

– Merleen Leonce ’16, Risk Management Professional Certificate