Let's talk finance with the experts from Wall Street.

Now Available! Business Taxes: COVID-19 Related Tax Relief

This pre-recorded session of NYIF Talks is led by NYIF Instructors and experts on the topic, Jack Farmer (Academic Director, New York Institute of Finance) and Paul Wiley (Head of Tax, Highbridge Capital Management LLC) and addresses the key questions professionals are asking about COVID-related tax relief.

In 30 minutes:

-

-

Review the timeline of COVID-related legislation to-date and several changes recently made to tax rules in the US.

-

Examine the most significant business tax changes that affect the financial services industry.

-

Lastly, analyze an existing tax election that may provide a benefit to securities traders in 2020.

-

Stay Informed! Get the latest news, upcoming course notifications, and promotions directly to your inbox.

New! Business Taxes: COVID-19 Related Tax Relief

Legislation in the wake of the coronavirus pandemic has resulted in several changes to tax rules in the US. This 3-chapter free video series focuses on the timeline of the legislation to-date, the most significant business tax changes that affect the financial services industry, and an existing tax election that may provide a benefit to securities traders in 2020.

Chapter 1: Tax Legislation Timeline

Review the timeline of COVID-related tax legislation to-date.

Chapter 2: Net Operating Losses

Examine the most significant business tax changes that affect the financial services industry.

Chapter 3: Tax Benefits

Analyze an existing tax election that may provide a benefit to securities traders in 2020.

Want to learn more about this topic? Browse these virtual and on-demand courses: Financial Accounting and Accounting for Mergers & Acquisitions

The Impact of COVID-19 on Investment Allocations and Portfolio Management

In this pre-recorded session of NYIF Talks, examine the impact of COVID-19 on investment allocations and portfolio management. This 3-chapter free video series is led by NYIF Instructors and experts on the topic, Chris Thomas (Managing Director, Simon Quick Advisors, LLC) and John Palicka (President and Chief Portfolio Manager, Global Emerging Growth Capital) and focuses on where the stock market and interest rates are going. Reviews different approaches and strategies to help guide your investing decisions during the COVID-19 pandemic. Lastly, surveys the risks and opportunities of alternative investing and more. Download the Sunrise Stocks, Year to Date Performance, and Gold Charts featured in this session of NYIF Talks.

Chapter 1: Market Trends & Analysis

Gain a comprehensive overview of the outlook for stock prices in a year’s time. Find out what can help guide your investing decisions while fundamentals remain uncertain.

Chapter 2: Interest Rates & Fixed Income

Analyze the direction interest rates are going and investment considerations for fixed income investors.

Chapter 3: Investment Strategies & Alternative Investments

Gain insights on which investment strategies to consider during the COVID-19 pandemic. Review the opportunities, risks, and strategies for alternative investments including real estate, private equity, distressed securities, and more.

Want to learn more about this topic? Browse these virtual and on-demand courses: Portfolio Management Professional Certificate: Online, Fundamentals of Technical Analysis, Wealth Management, Portfolio Management II

The Impact of COVID-19 on Corporate Borrowers and Debt Markets

In this pre-recorded session of NYIF Talks, examine the impact of COVID-19 on corporate borrowers and debt markets. This 5-chapter free video series is led by NYIF Instructors and experts on the topic, Tracy Williams (Financial Consultant) and Jerome Wong (CFO, Molon Labe LLC) and focuses on the ways to adjust and revise credit and debt analysis in a deteriorating environment. Examines the recent responses and strategies of corporate borrowers. Surveys the new risks faced by banks and updates in debt markets. Lastly, gauges the responses and reactions from rating agencies and identifies which corporate industries are most and least at risk.

Chapter 1: Adjusting for a Downturn

Gain a comprehensive overview of how to adjust and revise credit and debt analysis in a deteriorating environment.

Chapter 2: Corporate Response

Examine the recent responses and strategies of corporate borrowers.

Chapter 3: Bank Risks

Survey the risks that banks face in an uncertain environment including balance sheets, capital adequacy, credit risks, liquidity, and market risks.

Chapter 4: Debt Markets

Evaluate how bank-lending and debt markets may respond to corporates in the periods to come for new debt needs and refinancing including syndicated bank lending, commercial paper, and public and private debt markets.

Chapter 5: Ratings Agencies & Corporate Industries

Assess the responses and reactions from rating agencies and identify the corporate industries that are most and least vulnerable.

Want to learn more about this topic? Browse these virtual and on-demand courses: Credit Risk Analysis Professional Certificate, Risk Management, Credit Ratings and Credit Scoring

The Impact of COVID-19 on Financial Markets

In this pre-recorded session of NYIF Talks, examine the impact of COVID-19 on financial markets. This 3-chapter free video series is led by NYIF Instructors and experts on the topic, Jack Farmer (Academic Director, New York Institute of Finance) and Douglas Carroll (CFA Content Specialist, UWorld) and focuses on the impact of COVID-19 on stocks, bonds and money markets globally. Addresses the impact on the real economy in terms of job losses, trade, and potential reductions in GDP. Reviews the steps central banks throughout the world have taken to stabilize markets and provide liquidity. Lastly, surveys the main components of the $2 trillion+ fiscal stimulus announced by the U.S. government.

Chapter 1

Examine the impact of COVID-19 on the real economy including disruption of the supply chain, layoffs, reduction in capital investment, and infection rate. Gain a comprehensive overview of the steps central banks throughout the world have taken to stabilize markets and provide liquidity.

Chapter 2

Gain an overview of the Government Stimulus and impact it will have on individuals and small to large businesses. Review the contraction and recovery prospects for the US economy and equity markets, shifts in investors’ risk tolerance, limiting share buybacks, and liquidation of private equity holdings.

Chapter 3

Examine the impact of Fed interventions and the potential of the US 10-year T-note yields going negative.

Want to learn more about this topic? Browse these virtual and on-demand courses: Capital Markets, Risk Management, Mortgage Backed Securities

NYIF Talks Featured Instructors

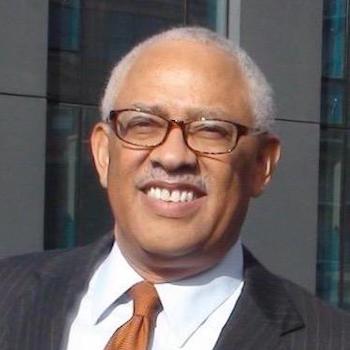

Tracy Williams

Tracy is currently consulting in finance, investment banking, and risk management. A former Managing Director in the Financial Institutions Group at JPMorgan Investment Bank for 10 years. He headed risk management, loan structuring, loan operations, portfolio management and credit approvals for the broker/dealer and securities-industry client base (more than 250 institutions). Tracy spent 27 years in total at JPMorgan Chase (and heritage institutions) in the financial institutions and loan restructuring groups.

Tracy specializes in courses related to credit risk management, credit portfolio management, financial analysis, credit analysis and corporate finance (asset and corporate lending). He has also taught courses in analysis of financial institutions, including risk management, banks, broker/dealers, exchanges and hedge funds. He has wide-ranging experience with the securities industry and broker/deal clients and counterparties.

Jerome Wong

Jerome Wong is the CFO for Molon Labe LLC, a portfolio company of the angel group he co-founded, Angelus Funding LLC. The group’s portfolio includes investments in advanced materials, medical devices, Blockchain technology, software, drones, and several other sectors. Mr. Wong is also currently the program director of the Masters of Science in Global Finance at The Gabelli School of Business at Fordham University, as well as an adjunct professor for the program.

Jerome Wong had established successful careers in global finance and technology. His last corporate position was as Managing Director of Credit Structuring & Advisory at BNP Paribas in NY, where he was able to successfully expand his business during the height of the financial crisis. Previously he held similar roles at Citibank, UBS and Chase Manhattan Bank working in New York, London and Hong Kong where he managed groups creating financial products and solutions for banks, insurance companies, and asset management firms. Prior to graduating with an MBA in Finance from Columbia Business School, he worked in the greater Boston area in engineering and technical sales positions in digital image processing, software and defense companies. He had also received a BS in Electrical Engineering from Tufts University. His accomplishments include writing a career development book for college students, “Landing Internships and Your First Job: Why Qualifications Are Not Enough”.

Jack Farmer

Jack is currently the Academic Director for the New York Institute of Finance. Farmer also acts as an outside adviser for portfolio managers at significant global investment funds. These funds included emerging markets equity funds and global macro hedge funds. Jack serves a variety of functions for the funds he advises, including the development of options strategies, quantitative strategies, and hedging strategies. Additionally, Jack specializes in capitalizing on systemic and macroeconomic imbalances in equity and fixed income markets throughout the world.

Douglas Carroll

Doug has been conducting investment training seminars for more than a decade. The bulk of his work relates to analysis and valuation of derivatives and fixed income securities. His experiences in sales, trading and investment management are supplemented by rigorous grounding in the legal, regulatory and theoretical aspects of the financial markets.

Chris Thomas

Chris is the Managing Director at Simon Quick Advisors, LLC, a Multifamily Office based in Morristown, NJ, and New York City.

Chris specializes in education and training on how hedge funds work and behave in an investment portfolio, having spent more than 15 years on Wall Street working in alternative investments. He has managed hedge fund of funds, marketed hedge funds, and created multiple hedge fund products. He has introduced investors and other financial professionals to the hedge fund space.

As a former Senior Managing Director at Forefront Capital, Chris headed client development and was involved in product development and deal origination. He also was a Senior Vice President and head of U.S. alternative investment product distribution for Lehman Brothers; a Director at Bank of America; and a Regional Sales Manager at Merrill Lynch.

John Palicka

John has over 30 years of experience in researching and managing money in global, emerging, and US small-cap stocks. He is currently the President and Chief Portfolio Manager at Global Emerging Growth Capital (GEGC).

GEGC provides three major financial services; asset management, corporate finance, and knowledge consulting. John is responsible for managing global small-cap assets that have been ranked consistently in the upper quartile by consultants and reporting agencies such as Russell, Nelson, PSN and MMR. Since 1980 his funds have doubled client money every five years, on average. This has been done with excellent risk measures, such as Sharpe and the Information Ratio. He has also advised a niche offshore institutional global fixed income fund for a major bank. Currently, GEGC operates mostly as a family office.

John also beat out several prominent global money managers for the award of a major Polish NIF government fund and evaluated the largest private equity voucher fund in Bulgaria. He also created an institutional research list of Central and Eastern European companies that outperformed the respective indices of IFC and MSCI; developed and marketed corporate finance deals in the region and negotiated joint investment ventures in Russia and the Ukraine. He has also teamed with other managers in advising and developing asset management products in Eastern Europe, GCC, and Asia. He is a member of the Financial Analysts and Money Managers of New York and has taught finance courses at the Columbia Business School, Baruch, and New York University. He also teaches the CFA program, CMT Technical Analysis, and several finance courses, such as portfolio theory, investments, and corporate finance at NYIF. Mr. Palicka has been quoted in business periodicals such as Business Week, Emerging Markets, Equity magazine, and the Wall Street Journal and has been interviewed on CNBC. He has also written articles in various business publications and is the author of the finance book, Fusion Analysis.

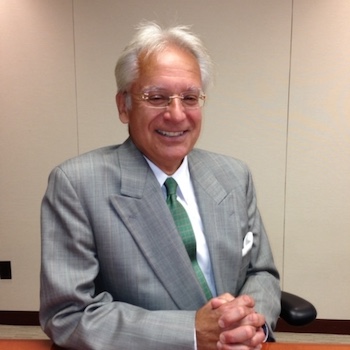

Paul Wiley

Paul Wiley is a NYIF faculty member specializing in Taxation, Hedge Funds, and Alternative Investments. Paul has 20 years of experience in the alternative investment industry. He has concentrated on a wide variety of domestic and international tax issues, including allocation methodologies, cross-border structuring, and the various aspects of financial products and transactions.

Paul is currently Head of Tax at Highbridge Capital Management LLC, a global alternative investment firm offering credit-focused solutions across a range of liquidity and investment profiles including hedge funds, drawdown vehicles, and co-investments.

Paul is a member of the Managed Fund Association’s Tax Steering Committee.

Prior to Highbridge, Paul led the Fund Tax team at Bridgewater Associates LP, an investment management firm handling over $160 billion for approximately 350 of the largest and most sophisticated global institutional clients including public and corporate pension funds, university endowments, charitable foundations, supranational agencies, sovereign wealth funds, and central banks. Bridgewater utilizes a global macro investing style based on economic trends such as inflation, currency exchange rates, and U.S. gross domestic product. Prior to that, Paul serviced the financial services industry as Senior Manager at Untracht Early LLC, a “Top 200” accounting, tax, assurance, and consulting firm, where he led the entity group. Paul was also Controller at WL Ross & Co LLC, a private equity company focused on investments in financially distressed companies with undervalued stocks in the United States, Asia, Korea, Ireland, Japan, France, and China.

About NYIF

The New York Institute of Finance (NYIF) is a global leader in professional training for financial services and related industries. NYIF courses cover everything from investment banking, asset pricing, insurance and market structure to financial modeling, treasury operations, and accounting. The New York Insitute of Finance has a faculty of industry leaders and offers a range of program delivery options, including self-study, online courses, and in-person classes. Founded by the New York Stock Exchange in 1922, NYIF has trained over 250,000 professionals online and in class, in over 120 countries.

See all of NYIF’s training and qualifications here.

Questions or Concerns? Contact us at (347) 842-2501 or email customerservice@nyif.com