This article on how swap risk is calculated is the conceptual view of how firms and CCP’s calculate the initial margin on interest rate swaps. While the numbers reflect a real at-market swap given the terms and conditions described they may vary widely from what your firm or clearinghouse requires. Thus this article covers how the independent amount (initial margin) on a market swap would be viewed. First, let’s define and understand the differences between cleared verse and bilateral derivatives contracts.

Cleared & Bilateral Contracts

- Cleared Derivatives are derivative contracts which are executed via phone or electronic execution network buy CLEARED at a Central Counter-party (CCP). Cleared derivatives require initial margin to be posted to the clearinghouse by both counterparties. Profits & Losses are exchanged daily.

- Bilateral Derivatives are derivative contracts which are executed via phone or electronic execution network and held as a private contract by both counterparties. Bilateral Swaps require an independent amount to be posted as a good faith deposit. Profits & Losses are exchanged daily.

Other Differences Between Cleared & Bilateral Contracts

1. The CCP risk manages cleared contracts. The CCP becomes the counterparty to all contracts cleared. All counterparties

post the same amount of margin for a swap with the same terms and conditions.

2. Documentation alters significantly

3. Bilateral contracts are risk managed with each counterparty individually. Each counterparty is assigned a different

derivatives limit (larger counterparties are able to trade in larger size and perhaps for longer tenors) and margin threshold.

– Cleared Contracts require the documentation of the clearinghouse, additionally, they require a collateral document (i.e., third party Repo) to show the CCP the counterparty can post collateral.

– Bilateral Contracts require the ISDA Master Agreement and Annex A, additionally, they require a Standard Initial Margin Method (SCSA) and nowadays the General Master Repurchase Agreement (GMRA). Collectively these documents bind the two counterparties together and spell out how they will conduct all business with each other.

Risk Of An Interest Rate Swap

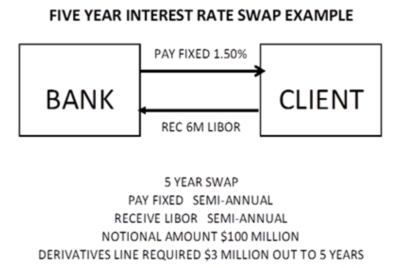

Sample: 5 year swap (“we” the bank are paying fixed and receiving LIBOR)

The primary risks of a single currency swap are:

1. Counterparty Credit Risk (effected by the periodicity of payments of the swap)

2. Volatility Risk (effected by the tenor of the swap)

Impact of Counterparty Credit Risk

1. Between payment dates, if we are paying the fixed rate and the rate goes down… we are making money.

We will receive collateral from the counterparty.

2. Between payment dates, if we are paying the fixed rate and the rate goes up… we are losing money.

We will pay collateral to the counterparty.

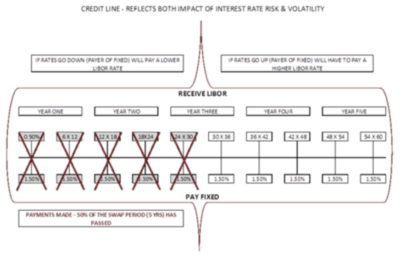

The image below illustrates market risk exposure over the life of the swap:

The Impact of Periodicity of Payment

A swap that is both paying and receiving on the same periodicity being used.

1. Assume we’re paying fixed on a semi-annual schedule and receiving LIBOR on a quarterly basis.

We are receiving the quarterly cash flow twice as often as we are paying our semi-annual cash flow. Therefore we will have less risk.

2. If we take this to an extreme – we are paying fixed once a year and receiving LIBOR on a monthly basis.

11 cash flows will be received before we have to pay out our one-year cash flow. Therefore, we can observe the payment record of the counterparty for 11 months.

Impact Of Counterparty Credit Risk As Time Passes

The image below illustrates Credit Risk Exposure of a 5 year Swap as time passes:

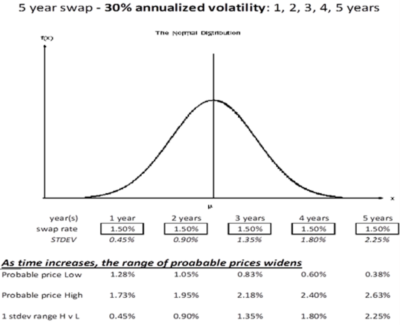

The Impact Of Volatility

1. As time to maturity increases, the impact of volatility rises

Volatility, Market Risk and MPE

At inception of the 5 year swap:

1. Maximum Potential Exposure (MPE) comes in at roughly 2.5 years

2. As time passes MPE will decrease. With 2.5 years to maturity, MPE will come in at approximately 1.24 years.

Summary

1. The market risk of an interest rate swap is the combination of how often cash flow are paid and the difference in timing of

those cash flows.

2. These variables will have a direct effect on the Initial Margin of a Swap.

3. The longer the tenor of the swap, the larger the initial margin

4. Volatility effects the market risk of a swap as time to maturity is greater.

About The New York Institute of Finance

The New York Institute of Finance (NYIF) is a global leader in professional training for financial services and related industries. NYIF courses cover everything from investment banking, asset pricing, insurance and market structure to financial modeling, treasury operations, and accounting. The New York Institute of Finance has a faculty of industry leaders and offers a range of program delivery options, including self-study, online courses, and in-person classes. Founded by the New York Stock Exchange in 1922, NYIF has trained over 250,000 professionals online and in-class, in over 120 countries.

See all of NYIF’s training and qualifications here.